The journey of Open Banking

Open Banking (OB) is increasingly shaping how customers and businesses spend and manage money, offering transparency, flexibility, and better control over financial habits. Innovation has thrived in the OB journey. There is now an active ecosystem of OB apps and platforms helping make banking easier, faster, safer and more reliable.

The birth of Open Banking

OB came into force in the UK in 2018 to allow customers and businesses to safely share bank account information with third parties that would then use that data to personalise services to suit customer needs. The benefits of deploying OB, include improvements to security, convenience, speed, and fraud prevention.

The OB programme was created to promote competition; newer and smaller banks can compete in the market against larger players. Competition acts as a further catalyst for innovation, encouraging the development of new products and services in financial services.

Does ‘open’ always mean ‘safe’?

The concept of ‘openness’ corresponding with banking and financial data has raised questions about OB’s level of security: “If something is open then surely it cannot be safe?”

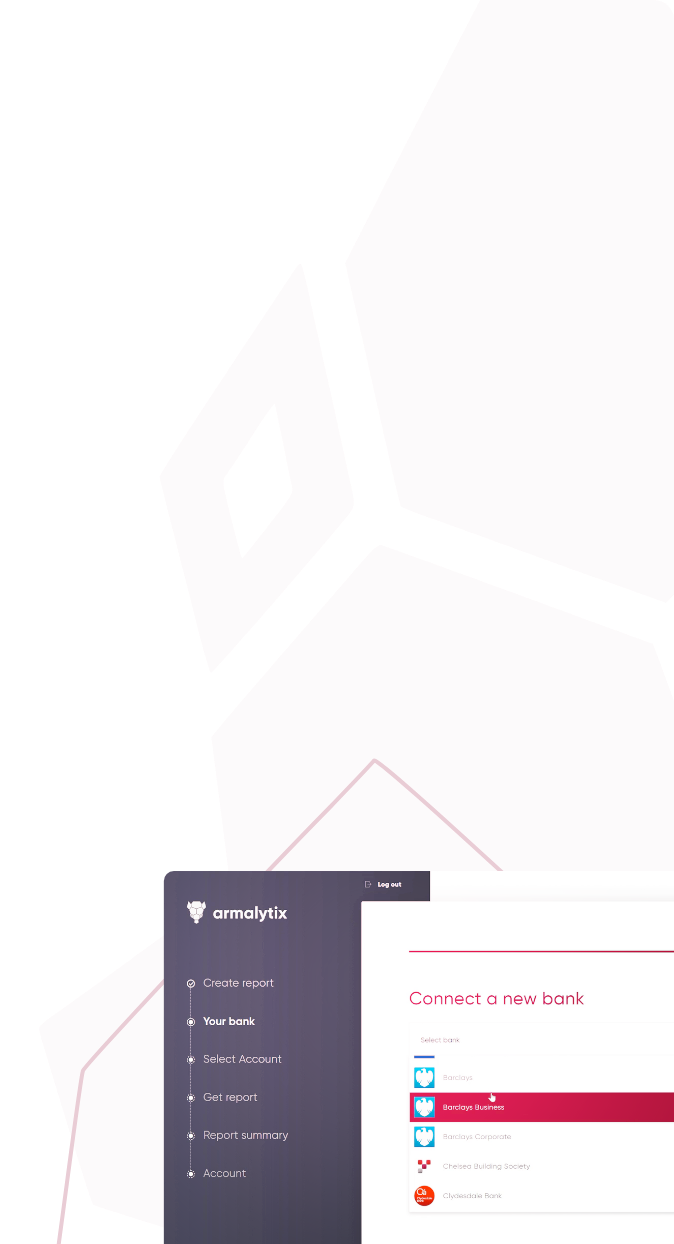

But OB has been designed with security at its core. It uses rigorously tested software and security systems that mean users are never asked for bank logins or passwords other than by the bank itself. Also, only apps and websites regulated by the FCA or European equivalent can enrol in OB. Access to financial data is only provided with the express permission of the data owner, who can limit the timespan of information or authorise for a single use. Even then the permission does not last forever and needs to be renewed on a semi regular basis. Users of OB are also covered by data protection laws and the Financial Ombudsman Service.

Despite the rigorous levels of security, OB could not be simpler to use. Authorisation can be provided by a few clicks on a computer mouse or through mobile apps.

The journey to Open Finance

The momentum is already building towards the next stage of OB: Open Finance. The objective of Open Finance is to further open up the market to competition and innovation. A user could, for example, bring all their investments, savings and other financial products together on one consolidated dashboard for an overview of their entire financial position.

The FCA announced in its 2019-20 business plan that it intended to extend OB into Open Finance. It subsequently requested feedback from the industry. Responses received suggest Open Finance could offer further benefits, including “increased competition, improved advice and improved access to a wider and more innovative range of financial products and services”.

This is not to say that the Open Finance initiative is not without challenges. Responses questioned the required security to protect data and there is little doubt that Open Finance would be a significant investment for companies. The FCA now plans to phase in Open Finance over time alongside an appropriate regulatory framework with common standards. Whatever the speed of implementation for Open Finance, it will be critical to ensure that the security and ease of use associated with OB continues to be critical to its success.